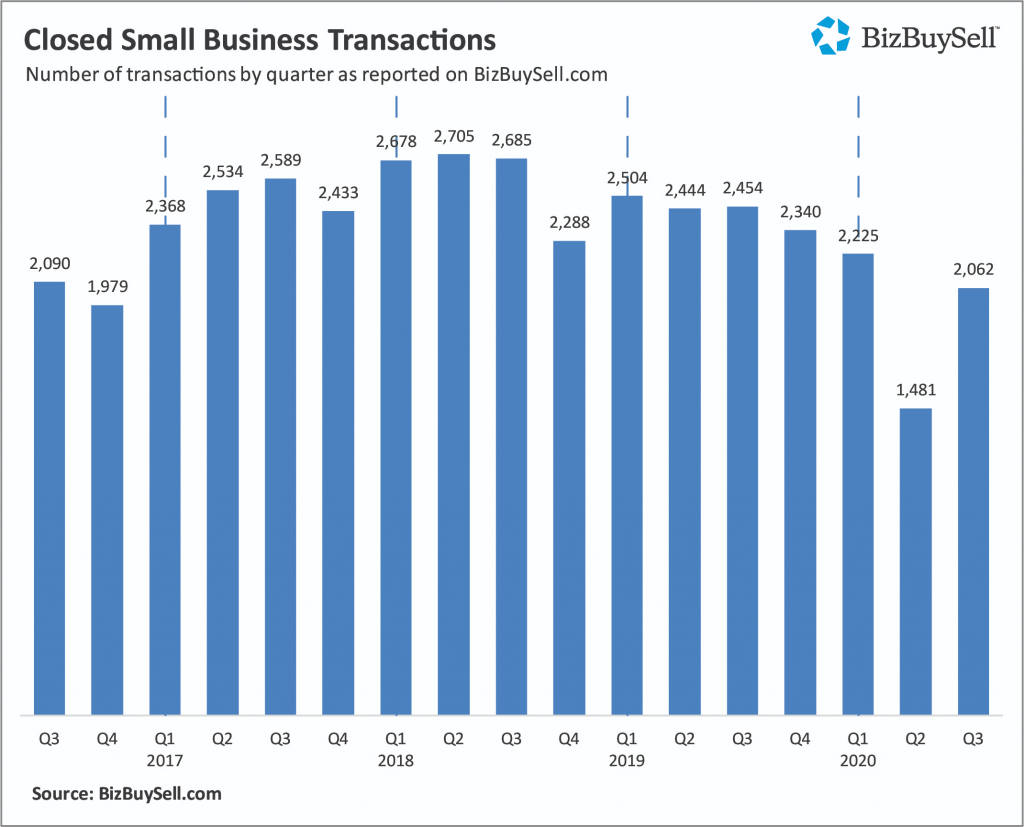

New data from BizBuySell’s Q3 2020 Insight Report (US data) depicts a market of opportunity-seeking-buyers and a mix of sellers who are well-positioned to profit from a sale or have been forced to exit their business. There has been a steady upward trend in new sales since the beginning of the COVID-19 pandemic. Transaction volume hit its lowest point in April, when year-over-year sales were down 51%. Throughout the third quarter, sales have continued to increase and were only down 5% year-over-year in the month of September.

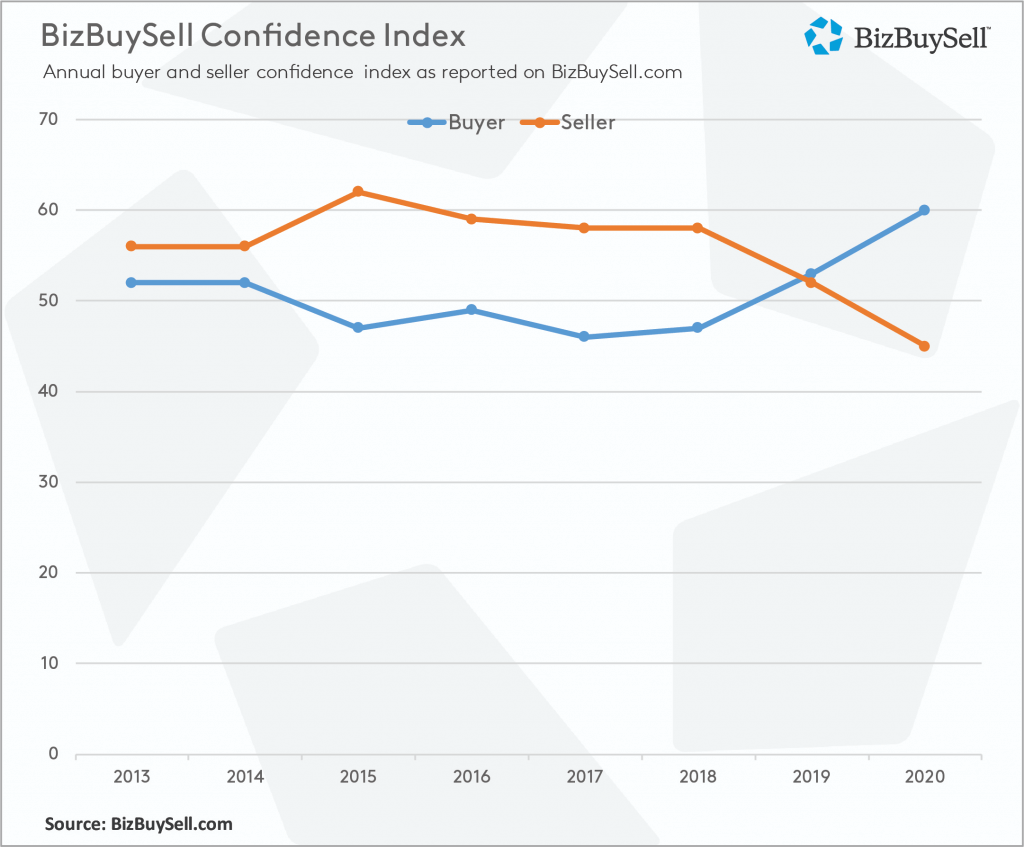

This increase in sales volume appears to be driven by an increase in buyer confidence, which was higher than the same time last year. Of the buyers surveyed in BizBuySell’s Small Business Confidence Survey, 57% believed that they could buy a business for a better value than last year, compared to only 19% in 2019.

While buyer confidence was up in Q3 of 2020, seller confidence declined. The majority of business owners indicated their biggest concern was business value, with 68% stating that they believe they would have received a better value for their business a year ago (compared to 37% in 2019). 71% of these owners believed that these lower values were being impacted directly by the pandemic.

While it seems that buyers in the market may be expecting better deals, the most desired businesses were “essential” businesses that have proven to be pandemic resistant. Based on BizBuySell’s survey, one in five businesses is performing better during the pandemic than they were in the period before the pandemic. Since these businesses are harder to find and are performing better than ever before, they come with less risk and a higher price tag. This is indicated by the 14% and 8% respective increase in median revenue and cash flow for businesses sold in the third Quarter.

Q3 data suggests that value buyers are increasingly looking at asset sales, where they are purchasing all or a portion of the assets owned by the business such as inventory, equipment, supplies, licenses, and real estate. Non-operating businesses such as gyms, restaurants, hair and nail salons are increasingly motivated to sell off equipment or get out of their lease. According the survey data, 47% of buyers are considering purchasing the assets of a closed business. There will likely continue to be an oversupply of these types of assets and limited buyer demand, potentially leading to further price reductions. For this reason, business owners that are considering this option for their non-operating business should think about expediting the process before prices decline further.

According to Q3 survey data, 66% of business owners that belong to the baby boomer generation have reported a decline in their business since the start of the pandemic, and 51% have indicated they have adjusted their timeline as a result. Of those that have adjusted their exit plan, 67% have extended their timeline, indicating that current values will not support their future lifestyle after retirement. For business owners that have enough cash flow to survive the uncertainty of the next six months to one year, it may be worthwhile waiting until things have recovered. For businesses that do not have the cash flows to survive this period of uncertainty, it may be wiser to sell now before values decrease any further.